20 Free Ideas For Choosing Ai Trade In Stocks

20 Free Ideas For Choosing Ai Trade In Stocks

Blog Article

Top 10 Tips To Regularly Monitoring And Automating Trading Stock Trading From Penny To copyright

For AI stock trading to be successful, it's essential to automate trading and keep a constant eye on. This is especially important in markets that move quickly such as penny stocks or copyright. Here are 10 ways to automate your trades, and to ensure that your performance is maintained through regular monitoring.

1. Set clear goals for trading

TIP: Determine your trading goals. This includes risk tolerance levels returns, expectations for return, preference for certain assets (penny stock or copyright, both) and many more.

Why: A clear purpose determines the choice of an AI algorithm rules for risk management, as well as trading strategies.

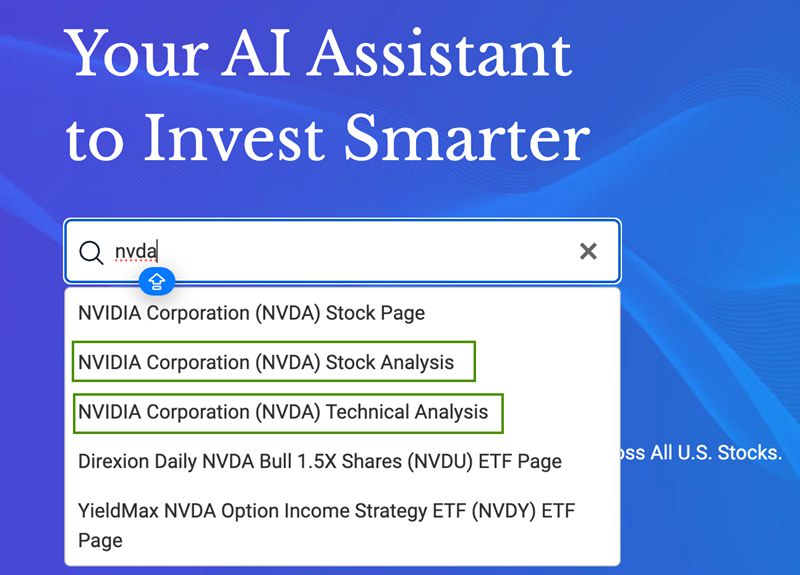

2. Reliable AI Trading Platforms

TIP #1: Use AI-powered platforms to automatize and integrate your trading into your brokerage or exchange for copyright. Examples include:

For Penny Stocks: MetaTrader, QuantConnect, Alpaca.

For copyright: 3Commas, Cryptohopper, TradeSanta.

What is the reason? Automation success relies on a solid platform and capability to execute.

3. Customizable Strategies for Trading are the Focus

Tip: Choose platforms that allow you to develop and modify trading algorithms that you can tailor to your strategy.

What's the reason? The strategy is customized to your style of trading.

4. Automate Risk Management

Tips: Set-up automatized risk management tools such as stop-loss order, trailing stops, and levels for take-profits.

This will safeguard you from massive losses in volatile markets, like copyright and penny stocks.

5. Backtest Strategies Before Automation

Tip: Test your automated strategies on historical data (backtesting) to test the effectiveness prior to launching.

Why? Backtesting allows you to try out the strategy and ensure it has potential. This reduces your risk of losing money on live markets.

6. Regularly monitor performance and adjust settings

Tip: Be aware of the performance, even if the trading process is automated.

What to Track: Profit loss, slippage and whether the algorithm is aligned with market conditions.

The reason: Continuous monitoring allows for rapid changes to the strategy should the market conditions alter. This helps ensure that the strategy remains efficient.

7. Implement adaptive Algorithms

Choose AI trading tools that adapt to changing conditions on the market by adjusting their parameters based on real-time trade data.

The reason: Since markets change frequently adaptable algorithms can be used to improve strategies for penny stocks or cryptos to match new trends and fluctuations.

8. Avoid Over-Optimization (Overfitting)

Don't over-optimize an automated system based upon past data. This could lead to overfitting, where the system performs better on backtests than in real conditions.

The reason: Overfitting may make it difficult for a strategy to generalize future market conditions.

9. AI for Market Analysis

Tips: Make use of AI to detect strange patterns in the markets or anomalies (e.g. sudden spikes in volume of trading or news sentiment, or copyright whale activity).

The reason: Being aware of these signals will allow you to adjust automated strategies prior to major market shifts.

10. Integrate AI into regular alerts and notifications

Tip: Set up real time alerts to market events or trade executions that are significant and/or significant, as well as any changes in the algorithm's performance.

The reason: Alerts notify you of market changes and allow for quick intervention (especially on volatile markets such as copyright).

Bonus: Use Cloud-Based Solutions for Scalability

Tip Cloud-based trading platforms provide more scalability, speedier execution and capability to run multiple strategy simultaneously.

Why: Cloud solutions allow your trading system to operate continuously, with no interruptions. This is particularly crucial for markets in copyright, which are never closed.

Automating trading strategies, and monitoring your account regularly can help you take advantage AI-powered stock trading and copyright to minimize risk and improve performance. Have a look at the best best stocks to buy now blog for website recommendations including best stocks to buy now, ai stock trading bot free, ai stocks to buy, best ai copyright prediction, ai trade, ai penny stocks, trading ai, ai stocks, best ai stocks, trading chart ai and more.

The 10 Best Tips To Finding And Choosing The Best Ai Stock Picker.

The right AI stockpicker is vital to maximising your AI-driven trading strategies particularly when dealing with volatile markets such as copyright or penny stocks. Here are 10 top suggestions to help you select the most efficient AI-powered stock picker.

1. Review Performance Review Performance History

Tip: Look for AI stock pickers with a proven track record of steady performance, specifically in the markets you plan to trade (penny shares or copyright).

Why: Historical performance provides insight into the effectiveness and credibility of AI under various market conditions. Always look at the performance metrics like annualized rates, win-rates, and drawdowns.

2. Assessment of the AI Models and Algorithms

TIP 1: Be aware of the algorithm of the AI stock picking algorithm. Machine learning, reinforcement learning, and deep learning are all popular models.

Why: Different algorithm strengths and weaknesses depend on the asset classes (stocks or copyright). Select the best algorithm to the strategies you employ to trade (e.g. sentiment analysis, or predictive analysis for copyright or penny stocks).

3. Test the platform's backtesting capabilities

Tip. Make sure that your AI platform is able to backtest it. You can then create a simulation of trading based on historical data to assess the accuracy of its results.

Backtesting is an assessment without risk of the AI's capabilities to make predictions based on historical data before it is used in live trading.

4. Analyzing data sources utilized by AI

Tips: Ensure that the AI is using various and reliable sources of information, such as financial reports as well as market moods and trends, and data from social media.

What is the reason? To make precise predictions, AI should use both structured data (financial reporting) as well as unstructured data (social media and news). This is particularly important in the fast-paced frequently sentiment-driven market for penny and copyright stocks.

5. Transparency is the highest priority.

TIP: Find platforms that make it clear the decisions their AI models take (e.g. factors that affect the stock selection).

The reason: An open AI makes it easier to comprehend, trust, and manage risk.

6. Assessment Risk Management Features

Tip - Make sure that the AI-based stock picker comes with built-in risk management tools including stop-loss, take-profit and position-sizing, as well as volatility controls and stop-loss.

The reason: Risk management is crucial to limit loss. This is especially the case in volatile markets such as penny stock and copyright where price fluctuations are possible.

7. Check for Customization, Flexibility, and Other Features

Tips: Choose an AI stock selector which lets you to tailor your strategies, risk preferences and trading conditions.

Why: Customization allows the AI to be adapted to your trading goals as well as your preferences and your risk tolerance. This is particularly important for markets that are niche, such as penny stocks, or new copyright currencies.

8. Find several exchanges and brokers that provide integration.

Tips: Search for an AI picker that is compatible with a range of stock brokers or copyright-exchanges. This lets you perform trades in various ways.

The reason is that integrating multiple platforms allows you to trade on a wide range of markets, optimize your trading activities and not be restricted to one exchange or broker.

9. Assess Support for Customers and Resources

TIP: Investigate the quality of support for customers and the educational resources offered by AI. AI platform. Search for platforms that provide tutorials and documentation as well as responsive customer service.

Why: A reliable support team will be able to assist you in solving problems fast. Education materials can allow you to better grasp the way AI functions and the best strategies to improve trading strategies.

10. Assess Fees and Cost-Effectiveness

Tip: Analyze the pricing structure of the AI stock picker and ensure that it is in line with your budget and the expected ROI.

The reason: AI can provide value at an the lowest cost. Hidden fees such as commissions, transaction fees, or subscription fees can affect the profit you earn.

Bonus: Look for Real-Time Updates and Alerts

Tips: Search for an AI platform with real-time notifications, updates, and alerts on copyright and stock opportunities.

Why: The capability to react quickly in fast-moving markets, such as copyright or penny stocks that can alter their conditions in just a few minutes, requires information in real-time.

Following these tips will aid you in selecting the best AI stock picker that is aligned with your trading goals and provides accuracy in predictive forecasting and risk management as well as the ability to modify. This method lets you make educated decisions irrespective of whether you wish to focus on small-cap stocks, equity with a large cap, or the constantly changing copyright market. Check out the recommended related site on ai stock picker for more examples including ai for stock trading, ai stock analysis, ai for stock trading, stock market ai, ai trading app, ai copyright prediction, ai copyright prediction, ai for trading, best ai stocks, ai stocks to invest in and more.